The future of financial advice is not high tech—it’s deep HUMAN thinking

(driven by advisors using tech)

ARE YOU READY FOR 2030?

“In the next ten years, advisers will gradually shed their role as investment managers and become more like integrated life/wealth coaches who advise clients on investments, banking, healthcare, protection, taxes, estate, and financial wellness needs more broadly. As the industry undergoes this shift, wealth managers will need to fundamentally rethink their recruiting strategies and training programs.”

McKinsey & Company On the cusp of change: North American wealth management in 2030 January 22, 2020 | Article

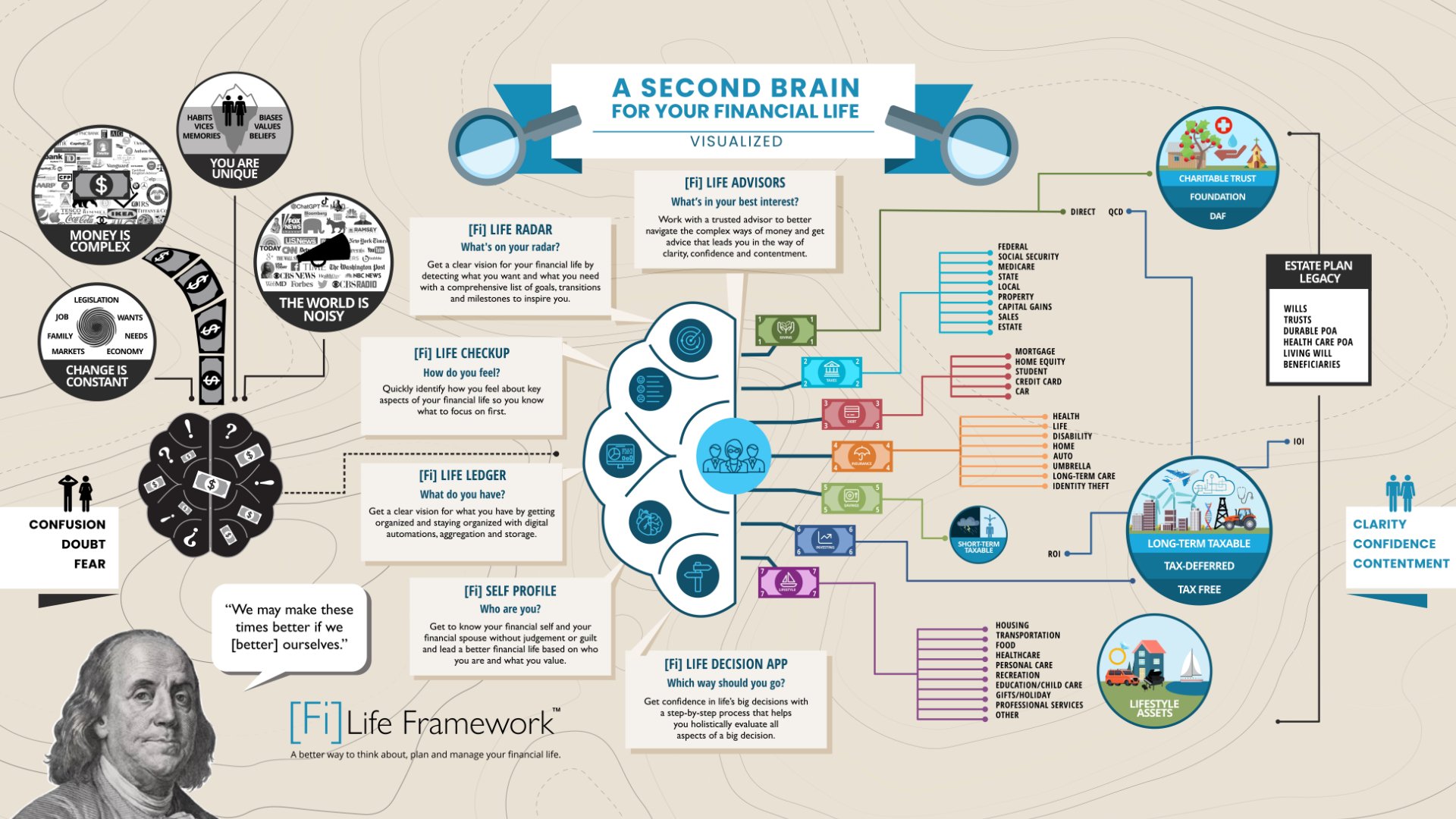

Putting the HUMAN SIDE of money into PRACTICE.

-

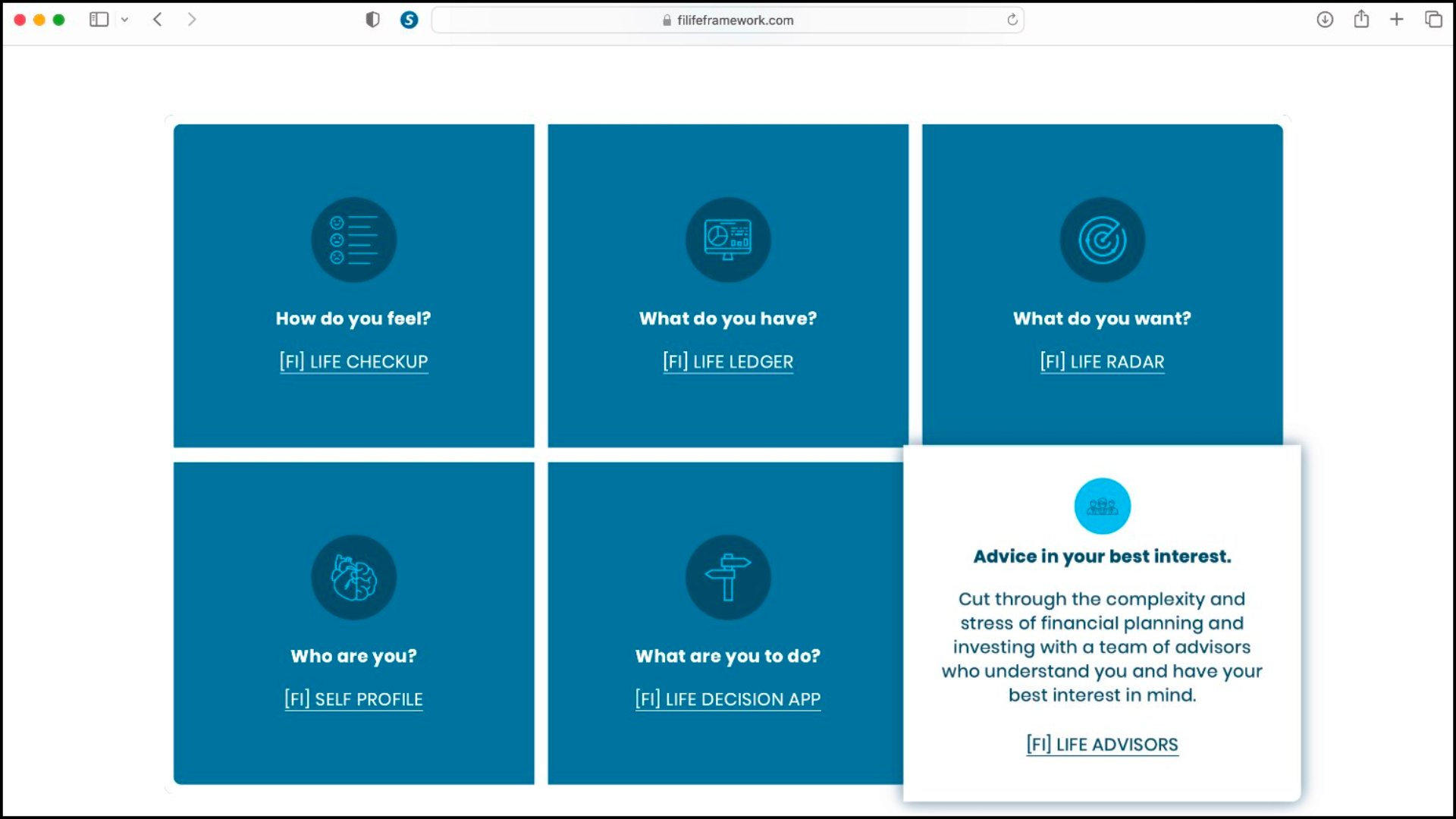

What’s on your radar?

Help clients visualize and prioritize what they want and what they need with a comprehensive list of goals, transitions and milestones to inspire them.

-

How do you feel?

Help clients quickly identify how they feel about key aspects of their financial life so you know what to focus on first.

-

What do you have?

Integrate your current planning tools or digital account access as part of the [Fi] Life Framework experience.

-

Who are you?

Help clients know their financial-self and their financial-spouse, without judgement or guilt, so they can lead a better financial life based on who they are and what they value.

-

Which way should you go?

Help clients gain clarity and confidence in life’s big decisions with a step-by-step process that helps them holistically evaluate all aspects of a big decision.

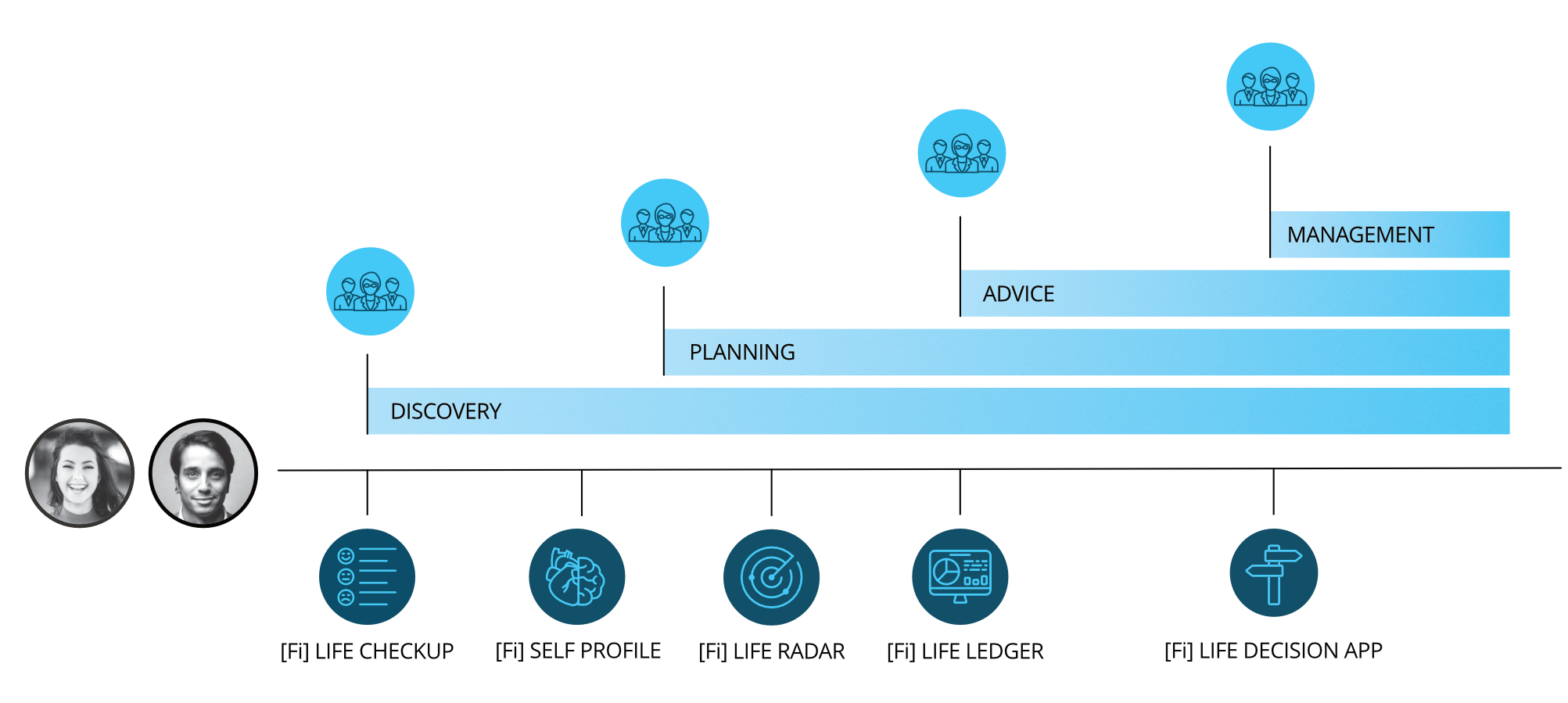

It’s Adaptable

The framework can be used simply as a unique discovery experience or as a structured way for advisors to incorporate the deeper aspects of behavioral finance into their practice.

It’s Agile

There is a theoretical approach to using the framework with clients, but it remains agile in practice, so advisors can incorporate the tools in way that doesn’t feel forced and out of place.

Technology that’s beautifully

designed and easy to use

Co-branded content and

communications

Strategy, coaching

and community

Being a good advisor isn’t about being good at portfolio construction and complex calculations. Yes, on the surface advice involves these things, but underlying the surface is a deeper more complex human dynamic.

The broader your perspective and the deeper your understanding on the human side of advice, the better you can help clients use money to enjoy life, promote human flourishing and learn contentment.

The future of financial advice is not artificially intelligent portfolios or decentralized ledgers. The future of financial advice is psychological, emotional and spiritual— same as it’s always been.

Josh Gilliam CKA®, BFA™

Founder of [Fi] Life Framework

This research aged well👇

The work of a financial advisor is

93.6% BEHAVIORAL

*Meir Statman, University of Santa Clara, California “The 93.6% Question of Financial Advisors,” Journal of Investing, Spring 2000].

The framework is a game-changer for anyone who believes in the power of the human side. As I went all in on the human side, I always struggled with two things.

First, how to consistently have great conversations that go beyond numbers. And, second, how to create deliverables that reflected those conversations.

These are the two biggest barriers for most advisors. And, the framework immediately solves both problems by providing a roadmap for facilitating conversations that go beyond the numbers and turning the conversation into a client experience that aligns money and life.

Brendon Fraiser

Host of the Human Side of Money

Podcast Wired Planning Founder

What the research says…

Financial Advice 3.0 comes with a new generation of tools and resources that allow advisors to focus on building stronger client relationships and providing clients with a more meaningful planning experience.

Holistic Wealth Planning goes beyond traditional financial planning. It engages a broader and deeper model of client engagement, considering factors across an investor’s life.

Focusing on behavioral coaching—in particular, helping clients adhere to their long-term plans—because that is the greatest potential value you can add.

Add more value and see more growth

ARE YOU READY?

The keys to the kingdom are changing hands. The future belongs to a different kind of advisor.

Add more value to your practice

Add value in succession or sale

Attract Next Gen advisors to your team

Serve more clients better

Better comply with “Best Interest” Regulations

Fast track really “Knowing Your client”

Deliver greater value virtually

Create more tangible/referable experiences

Find more meaning in your work

Connect with Next Gen clients and client kids

Be better positioned to capitalize on the “Great Wealth Transfer”

Articulate and demonstrate value with a clear and compelling process

Differentiate yourself to attract new clients

![[Fi] Life Advisor](http://images.squarespace-cdn.com/content/v1/65a16a43766b5d14ef5ce4bb/ad8b3b24-f160-4c81-a0a7-9d7e35b9e26b/%5BFi%5DLifeLogo.png?format=1500w)